At first glance, Qapital seems just like any other app geared toward helping consumers save money. But it is so much more than that. Not only can you set all kinds of saving rules, but the savings accounts act like checking accounts – you even get a Qapital Visa® card for easy access to what you’ve saved. It’s basically a money saving app that doubles as a bank account.

The founders wanted to create an app that “empowered users by putting their personal goals at the core of the product, and then supercharged their savings efforts with clever tips and tools rooted in behavioral psychology.” Debt.com’s product review team thinks they accomplished their goal. Read more about how the app works and what others are saying to see if you think they reached their goal, too.

How does Qapital work?

Qapital is different from other money saving apps because it is a full-fledged banking system. Its three main functions are saving, spending, and investing. Here’s how these functions work:

Saving

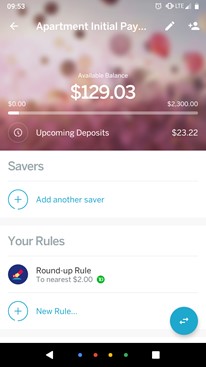

When you register with Qapital, you create a secure, FDIC-insured bank account to funnel your savings into. Then, in order to better save money and make the process more fun, you set goals and rules. Goals are displayed on the app’s dashboard and represent the main categories you are saving for. You assign each goal a cover photo and a monetary value. For example, one staff member who tried Qapital created this goal to save up for a deposit on a new apartment.

A rule, on the other hand, is how you start working toward your goals. There are plenty of present rules to choose from, such as rounding up purchases to the nearest dollar, automatic transfers, adding to savings when you spend on guilty pleasures, and saving the difference when you spend less than your budget.

Going back to our staff member’s apartment down payment example, she set a rule to round up to the nearest two dollars for every purchase. As a result, she’s already saved over $120 in just one month.

Spending

Because your Qapital account is technically a bank account, they send you a debit card after you register. The app helps you find a “Spending Sweet Spot” and monitor how you are spending the money you save.

Investing

In addition to routing money to your Qapital savings account, you can also set goals and rules for investing. The app will ask you some questions about your investment history and how willing you are to take risks. This helps the app understand your risk tolerance to help you invest accordingly. Then you tell them how much money you want by what date, set a rule, and let it go! Especially for beginner investors, this is a really great way to learn about investing while saving for your long-term goals.

Qapital Reviews

Like any app, Qapital has its fair share of positive and negative reviews. We summed up some of the most common feedback and added our own take on this banking and saving app.

Positive Qapital reviews: The upsides

With a 4.6/5 rating in the Google Play store and a 4.8/5 in the App Store for iPhone, it’s obvious this app has some major fans. The positive reviewers wrote excitedly about how much money they saved and how easy the app was to set up. One user said that having his savings in a completely separate account from his usual bank really helped him curb his spending. Another user said that it made saving for big trips easier without feeling like a strain on their wallet. There are also many positive comments about the user interface and the cute design of the app as a whole. When the positive reviews dipped below 5 stars, it was usually because the transfers from Qapital back to the users’ main bank accounts took longer than expected.

Negative Qapital reviews: The downsides

Some reviewers seemed to have issues with connectivity between their main bank and credit accounts and the app. Others complained that some of the savings rules didn’t trigger correctly. One reviewer was angry that the deposits to Qapital took so long and weren’t available right away, but the company responded to this review and said that the four-day hold on deposits was for security against identity theft. There are also some monthly fees, but many of the positive reviewers said that it’s worth it. One of the worst negative reviews stated that the app cost the user $120 in overdraft fees. The app is supposed to have an overdraft failsafe mechanism, but the company has even admitted that it doesn’t work all the time. If you set up a rule you can’t actually afford to follow, it could hurt your finances more than it helps.

Debt.com Staff Review of Qaptial

Our reviewer at Debt.com (the one mentioned above who is saving for a wedding and an apartment) really loves this app. Even though transfers can be slow, the rules she’s able to set are saving her much more money than her usual monthly scheduled transfer from her checking to her savings account. She said the investing part is one of her favorite features. She chose a portfolio with moderate risk, and she checks it every day to see how it’s doing.

Overall, Debt.com’s product review team says the design and usability for Qaptial are both great. We highly recommend giving this app a try if you’re facing challenges when it comes to saving money. If you’re looking for an app that makes it easy to save and even invest, then Qapital might be the best money saving app for you.